Fixed Income Products

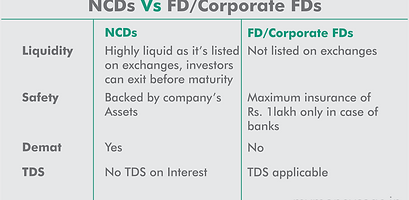

Company Fixed Deposit (corporate FD) is a term deposit which is held over fixed period at fixed rates of interest. Company Fixed Deposits are offered by Financial and Non-Banking financial companies (NBFCs). The maturities of various company fixed deposits can range from a few months to a few years.

Choose from multiple company fixed deposits options varying in tenures, interest rates and institutions to suit your investment needs. Avail stable returns and benefit from much reduced volatility through a wide range of AAA and AA-rated Company Fixed Deposits.

Benefits

-

Higher Return

-

Flexibility

-

Liquidity

-

Lower Risk

Choice Parameters

-

Credit Rating

-

Background of the company

-

Repayment History

Non-convertible debentures(NCDs) are a financial instrument that is used by companies to raise long-term capital. This is done through a public issue. NCDs are a debt instrument with a fixed tenure and people who invest in these receive regular interest at a certain rate

Advantages of NCDs

-

Better Return-NCDs offer better risk adjusted returns compared to other debt investment options.

-

Tenure- The debentures are generally offered in four options: monthly, quarterly, annual and cumulative interest.

-

Liquidity-NCDs can be traded in secondary market and hence offer liquidity.

-

No TDS- TDS is not applied on interest earned on NCDs.

BONDS

Bonds are debt securities issued by corporations and governments. Bonds provide safety of principal and periodic interest income. They tend to be less volatile and therefore provide stability. These Fixed Income are under less risk category and are issued by corporate and governments. Bonds add consistency to the portfolio.

Advantages of Bonds

-

Diversification

-

Liquidity

-

Yield to Maturity

-

Fixed Return

-

Low Risk

Capital Gain Bonds

Under Section 54EC of Income Tax, 1961 an investor need not pay any tax on any long-term capital gains arising on sale of any asset, if the amount of capital gains are invested in specified bonds. Rural Electrification Corporation Limited (REC) & National Highways Authority of India (NHAI), PFC and IRFC are permitted to issue capital gain bonds under Section 54EC.

-

Credit rating of AAA by CRISIL, CARE and FITCH

-

Interest is taxable although no TDS is deducted

-

Lock-in of around 5 years and non- transferable

-

Minimum amount of investment Rs 10,000 and multiples

-

During the entire five years from the deemed date of allotment the bonds are non transferable; & non negotiable

-